Introduction

In today’s business world, ensuring that your products are safe and reliable is more important than ever. One essential step in protecting your business from unforeseen risks is securing product liability insurance. This type of insurance plays a critical role in safeguarding your business against claims that might arise due to defects or product issues. This comprehensive guide will explore the ins and outs of product liability insurance, its importance, its various types, and how it can protect your business from financial losses.

What is Product Liability Insurance?

Definition of Product Liability Insurance

Product liability insurance is a specialized type of coverage that protects businesses from financial loss if a product they manufacture, distribute, or sell causes injury or damage. This insurance is crucial for companies involved in any part of the product lifecycle, as it provides coverage against claims arising from defects in manufacturing, design, or marketing.

Critical Components of Product Liability Insurance

Product liability insurance typically includes several key components:

- Manufacturing Defects: Coverage for claims resulting from errors during the production process.

- Design Defects: Protection against claims due to inherent flaws in the product design.

- Marketing Defects: Covers issues arising from improper instructions, labeling, or warnings.

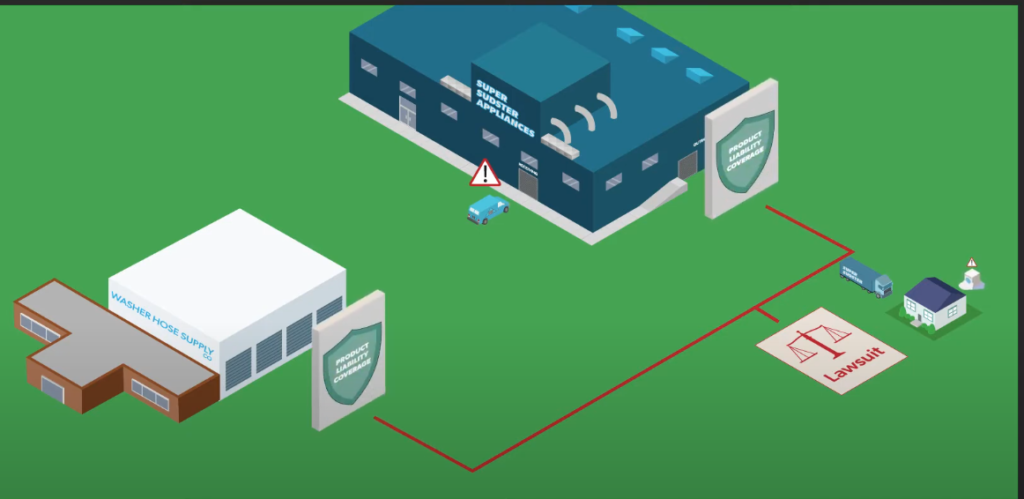

How Product Liability Insurance Works

When a claim is made against a business for a product-related issue, product liability insurance steps in to cover the legal costs, settlements, or judgments. This coverage ensures businesses are not financially devastated by a single claim, making it an essential part of risk management.

Importance of Product Liability Insurance

Legal Requirements and Compliance

In many industries, having product liability insurance is not just a wise decision but a legal requirement. Compliance with industry standards and regulations often necessitates carrying this type of insurance to avoid legal penalties and ensure businesses can continue operating smoothly.

Protection Against Financial Losses

Without product liability insurance, a single lawsuit could bankrupt a business. This insurance provides a safety net, covering the costs of defending a claim and any resulting damages or settlements. It’s a critical tool for managing financial risk.

Risk Mitigation for Manufacturers and Sellers

Product liability insurance is indispensable for manufacturers and sellers. It not only protects against the financial consequences of a lawsuit but also helps mitigate risks associated with product defects. With this coverage, businesses can focus on innovation and growth without the constant worry of potential legal battles.

Types of Product Liability Insurance

Comprehensive Product Liability Insurance

Comprehensive product liability insurance provides broad coverage, protecting businesses against claims arising from manufacturing defects, design flaws, and inadequate instructions or warnings. This type of insurance is ideal for companies looking for all-encompassing protection.

Table of Contents

Specific Product Liability Coverage

Some businesses might opt for more targeted coverage, focusing on specific risks associated with their products. This could include coverage for high-risk items that are more prone to causing injury or damage.

Combined Product and Public Liability Insurance

For businesses that interact directly with the public, combined product and public liability insurance offers protection against product-related claims and those arising from accidents on business premises.

Differences Between General and Product Liability Insurance

While general liability and product liability insurance provide essential protections, they cover different areas. General liability typically covers accidents on business premises, while product liability focuses on claims related to product defects.

Coverage in Product Liability Insurance

Coverage for Manufacturing Defects

Manufacturing defects occur during production and can lead to unsafe products reaching consumers. Product liability insurance covers claims related to these defects, protecting businesses from costly legal actions.

Coverage for Design Defects

Even if a product is manufactured correctly, flaws in the design can make it dangerous. Product liability insurance covers claims related to design defects, ensuring that businesses are protected if a product’s design leads to injury or damage.

Coverage for Marketing Defects (Failure to Warn)

Inadequate instructions, warnings, or labels can lead to consumer harm. Product liability insurance covers claims arising from these marketing defects, which can be just as damaging as manufacturing or design flaws.

Coverage for Retailers and Distributors

Product liability insurance is needed by not just manufacturers but also retailers and distributors, who can be liable for defective products. This coverage protects all parties involved in bringing a product to market.

Factors Affecting Product Liability Insurance Costs

Industry and Business Type

The type of industry and business operations play a significant role in determining product liability insurance cost. High-risk industries, such as food production or pharmaceuticals, typically face higher premiums due to the increased likelihood of claims.

Product Type and Risk Level

The nature of a business’s products also impacts insurance costs. Products that are inherently more dangerous, such as machinery or chemicals, will generally require higher premiums due to the increased risk of harm.

Business Size and Revenue

Larger businesses with higher revenues often face higher product liability insurance costs. This is because they are more likely to be the target of lawsuits, and the potential financial impact of a claim is more incredible.

Claim History and Risk Management Practices

A business’s claims history and risk management practices can significantly affect product liability insurance costs. Companies with a history of claims or poor risk management may face higher premiums, while those with a clean record and robust safety protocols may benefit from lower costs.

How to Choose the Right Product Liability Insurance

Assessing Your Business Needs

Selecting the right product liability starts with thoroughly assessing your business’s needs. This includes understanding the risks associated with your products, potential legal requirements, and financial exposure.

Comparing Insurance Providers

Not all insurance providers are created equal. It’s important to compare multiple providers to find the one that offers the best coverage for your business at a competitive price. Look for providers with a strong track record in handling product liability claims.

Understanding Policy Exclusions and Limits

Every product liability insurance policy has exclusions and limits. Understanding these is crucial to ensuring that your business is adequately protected. Review the policy details carefully to avoid any surprises in the event of a claim.

Importance of Customizing Your Insurance Policy

When it comes to liability insurance, one size does not fit all. Customizing your policy to fit your business’s specific risks and needs can help ensure that you are fully covered against potential claims.

Legal Aspects of Product Liability Insurance

Common Product Liability Lawsuits

Product liability lawsuits can arise from various issues, including manufacturing defects, design flaws, and marketing mistakes. Understanding the common types of lawsuits can help businesses prepare and protect themselves with the right product liability insurance.

Role of Product Liability Insurance in Legal Defense

In addition to covering settlements or judgments, product insurance is crucial in legal defense. This coverage can help pay for the legal costs associated with defending against a claim, which can be substantial.

Statutory Requirements for Product Liability Insurance

Different regions and industries may have statutory requirements for product insurance. Businesses must understand these requirements and ensure they comply to avoid legal penalties.

International Regulations and Product Insurance

Understanding the various international regulations related to product liability insurance is crucial for businesses that operate internationally. Countries have different standards and requirements, and companies must ensure they are adequately covered across all markets.

Claims Process in Product Liability Insurance

How to File a Product Liability Insurance Claim

Filing a product insurance claim involves several steps, including notifying your insurance provider, gathering evidence, and cooperating with the investigation. Understanding the process can help ensure your claim is handled smoothly and efficiently.

What to Expect During the Claims Process

The claims process for product liability insurance can be complex and time-consuming. Businesses should be prepared for a thorough investigation, including inspections, interviews, and legal consultations.

Common Challenges in Product Liability Claims

Several challenges may confront businesses during the product liability insurance claims process, including disputes over coverage, delays in claim resolution, and disagreements over settlement amounts. Being aware of these challenges can help businesses navigate the process more effectively.

Best Practices for Claim Management

Effective claim management ensures a positive outcome in a product liability insurance claim. This includes maintaining clear communication with your insurance provider, keeping detailed records, and seeking legal advice when necessary.

Case Studies in Product Liability Insurance

High-Profile Product Liability Cases

Examining high-profile product liability insurance cases can provide valuable insights into businesses’ risks and the importance of adequate coverage. These cases often involve large settlements and significant financial impacts on the companies involved.

Lessons Learned from Product Liability Claims

Learning from past product liability insurance claims can help businesses avoid common pitfalls and improve risk management practices. Case studies can offer practical lessons that can be applied to prevent future claims.

Successful Claims and Settlements

There are also many examples of successful product liability insurance claims where businesses could resolve disputes efficiently and fairly. These examples can highlight the benefits of having the right insurance coverage.

Impact of Product Liability Insurance on Businesses

The impact of product liability insurance on businesses goes beyond just financial protection. It also influences how businesses operate, manage risks, and build consumer trust. Understanding this impact can help companies to make informed decisions about their insurance needs.

Risk Management Strategies for Reducing Product Liability

Quality Control and Assurance

Implementing robust quality control and assurance practices is one of the most effective ways to reduce the risk of product insurance claims. Ensuring that products meet high standards before they reach consumers can prevent many potential issues.

Product Testing and Certification

Thorough product testing and certification are crucial for ensuring safety and compliance. By investing in these processes, businesses can reduce the likelihood of defects and the associated risk of product liability insurance claims.

Labeling and Packaging Compliance

Proper labeling and packaging are essential for preventing product liability insurance claims. This includes providing clear instructions, warnings, and other information to ensure consumers use products safely.

Consumer Education and Instructions

Educating consumers about the proper use of products can help prevent accidents and injuries, reducing the risk of product liability insurance claims. Providing detailed instructions and support can also enhance customer satisfaction and loyalty.

Future Trends in Product Liability Insurance

Impact of Emerging Technologies

Emerging technologies, such as artificial intelligence and the Internet of Things (IoT), are changing the landscape of product liability insurance. These technologies present new risks and opportunities for businesses, and staying ahead of these trends is crucial for maintaining adequate coverage.

Evolution of Consumer Protection Laws

Consumer protection laws constantly evolve, and businesses must stay informed about these changes to ensure compliance. This evolution can also impact the scope and cost of product liability insurance coverage.

The Growing Importance of Cybersecurity in Product Liability

Cybersecurity has become a critical concern in product insurance as products become increasingly connected. Protecting products from cyber threats is essential for preventing claims related to data breaches, hacking, and other cyber incidents.

Predicting Future Risks and Insurance Needs

Emerging risks, technological advancements, and changes in consumer behavior will shape the future of product liability insurance. Businesses must proactively predict these trends and adjust their insurance coverage accordingly.

Conclusion

Product liability insurance is an essential safeguard for businesses of all sizes. Companies can make informed decisions that protect them from financial risks by understanding the different types of coverage, the factors that affect insurance costs, and the legal aspects of product liability. As the business landscape evolves, staying informed about trends and best practices in product insurance will be crucial for maintaining a strong and resilient business.

Leave a Reply