Introduction to Business Owner Policy Insurance

What is Business Owner Policy Insurance?

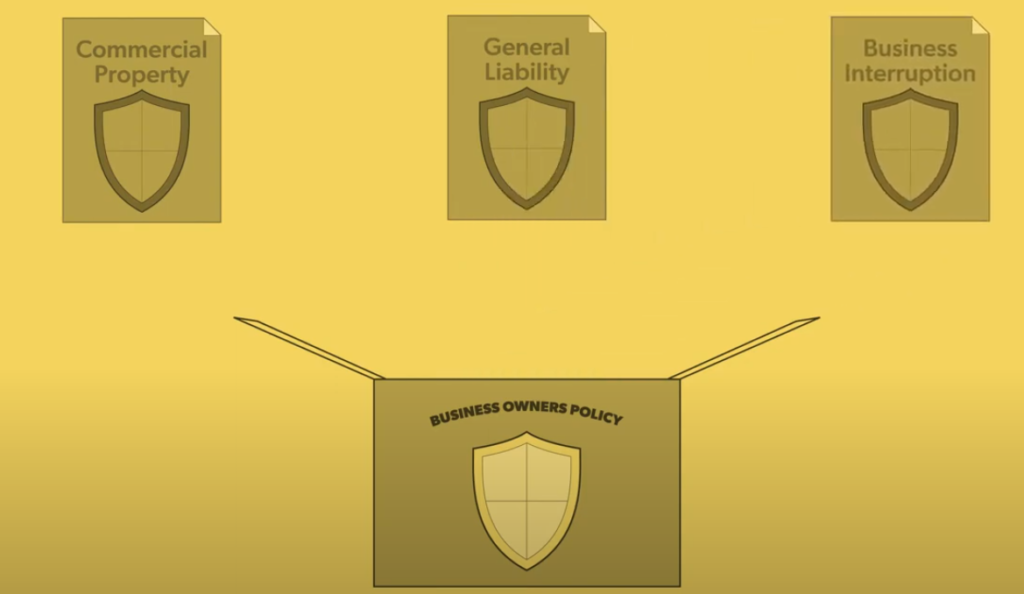

Business Owner Policy Insurance, often abbreviated as BOP insurance, is a comprehensive package designed to meet the diverse needs of small and medium-sized businesses. It typically combines several essential types of coverage into one convenient policy. This type of insurance helps protect business owners from financial losses due to various risks and liabilities that can arise while running a business.

A Business Owner Policy Insurance generally includes General Liability, Property, and Business Interruption Insurance. By bundling these coverages, BOP insurance offers a cost-effective way to secure your business against common threats, making it a popular choice among entrepreneurs and business owners.

Why is it Important for Business Owners?

Business Owner Policy Insurance is crucial because it provides a safety net for business owners against unexpected events. Without adequate coverage, a single incident could result in substantial financial hardship or even jeopardize the future of the business. For instance, a lawsuit resulting from a customer injury or property damage could lead to significant legal and repair costs.

Additionally, Business Owner Policy Insurance ensures that you are protected from liability and interruptions that could disrupt your business operations. In today’s unpredictable business environment, having a comprehensive insurance policy is more important than ever.

Critical Components of a Business Owner Policy

General Liability Insurance

Coverage Details

General Liability Insurance is a fundamental component of a Business Owner Policy Insurance. It covers a range of liabilities, including bodily injury, property damage, and personal injury claims. For example, if a customer slips and falls on your business premises, this coverage helps cover medical expenses and legal fees.

Common Claims Covered

Common claims covered under General Liability Insurance include:

- Slip-and-fall accidents.

- Property damage caused by your employees.

- Claims related to advertising injuries, such as copyright infringement.

This insurance is essential for safeguarding against the costs associated with these types of incidents.

Property Insurance

Types of Property Covered

Property Insurance within a Business Owner Policy Insurance covers the physical assets of your business, including buildings, equipment, inventory, and furniture. This coverage helps protect your business from damage or loss due to fire, theft, or vandalism.

Importance for Business Assets

Property Insurance is crucial for preserving the value of your business assets. Without it, a significant loss or damage to your property could result in costly repairs or replacements that might not be financially feasible. This coverage ensures that your business remains operational even after unforeseen events.

Business Interruption Insurance

What It Covers

Business Interruption Insurance is designed to cover lost income and operational expenses if your business is temporarily unable to operate due to a covered event. This type of insurance helps compensate for the income you would have earned if the company had been running normally.

Scenarios Where It Is Useful

Business Interruption Insurance is particularly useful in natural disasters, fires, or other events that disrupt your ability to operate. For example, if a fire damages your premises, this coverage helps compensate for lost revenue and ongoing expenses while your business is closed for repairs.

Table of Contents

Additional Coverage Options

Professional Liability Insurance

Professional Liability Insurance, or Errors and Omissions Insurance, provides coverage against claims of negligence or inadequate performance related to professional services. This is especially important for businesses that provide specialized advice or services.

Workers’ Compensation

Workers’ Compensation Insurance covers medical expenses and lost wages for employees injured or become ill due to their work. It also helps protect your business from legal claims related to workplace injuries.

Cyber Liability Insurance

Cyber Liability Insurance is increasingly essential in today’s digital age. It covers the costs associated with data breaches, such as legal fees, notification costs, and credit monitoring services. This coverage helps protect your business from the financial impacts of cyberattacks and data breaches.

Benefits of Having a Business Owner Policy

Financial Protection

Coverage Against Lawsuits

One of the primary benefits of Business Owner Policy Insurance is financial protection against lawsuits. Whether it’s a customer injury or a property damage claim, having adequate insurance ensures that your business is shielded from potentially crippling legal expenses.

Protection from Property Damage

Property damage can be devastating for any business. Business Owner Policy Insurance provides the necessary coverage to repair or replace damaged property, ensuring your business can recover and continue operations with minimal disruption.

Business Continuity

Ensuring Operations During Disruptions

Business continuity is a critical aspect of Business Owner Policy Insurance. By providing coverage for business interruptions, this insurance helps ensure that your operations can resume quickly after a disruption. This means less downtime and more stability for your business.

Financial Stability

Any business must maintain financial stability during challenging times. Business Owner Policy Insurance offers a financial cushion that helps your business weather unexpected events and maintain economic health.

Peace of Mind

Reducing Risks

Having a comprehensive Business Owner Policy Insurance gives you peace of mind by reducing the risks associated with running a business. Knowing that you are protected against various liabilities allows you to focus on growing your business without worrying about potential setbacks.

Focusing on Business Growth

With adequate insurance coverage, you can concentrate on expanding your business and achieving your goals. Business Owner Policy Insurance takes care of the risks, allowing you to invest time and resources into developing and improving your business.

Choosing the Right Business Owner Policy Insurance

Assessing Your Business Needs

Evaluating Risks and Liabilities

Before purchasing Business Owner Policy Insurance, evaluating your business’s specific risks and liabilities is essential. Consider factors such as your industry, location, and size to determine what coverage you need.

Determining Coverage Amounts

Determining the appropriate amount of coverage is crucial. Underestimating your coverage needs can leave your business vulnerable while overestimating can lead to unnecessary costs. Assess your potential risks and consult with insurance experts to determine coverage levels.

Comparing Insurance Providers

What to Look for in an Insurer

When choosing an insurer for your Business Owner Policy Insurance, consider factors such as the provider’s reputation, financial stability, and customer service. Look for insurers with a strong track record in handling claims and providing support to business owners.

Reading Reviews and Ratings

Reading reviews and ratings from other policyholders can provide valuable insights into the quality of an insurer’s services. To make an informed decision, pay attention to feedback on claim processes, customer support, and overall satisfaction.

Understanding Policy Terms

Key Terms and Conditions

Understanding the terms and conditions of your Business Owner Policy Insurance is essential. Familiarize yourself with key terms such as coverage limits, deductibles, and exclusions to ensure you know exactly what is covered.

Exclusions and Limitations

Every insurance policy has exclusions and limitations. Review these carefully to avoid surprises when making a claim. Knowing what needs to be covered will help you manage your risks and seek additional coverage if necessary.

How to Purchase Business Owner Policy Insurance

Getting Quotes

How to Request Quotes

To get quotes for Business Owner Policy Insurance, you can request them from various insurance providers. This can be done online, over the phone, or through an insurance broker. Providing accurate information about your business will help you receive accurate quotes.

Comparing Different Quotes

Once you have received quotes from multiple providers, compare them to find the best value. Look beyond the price and consider the insurer’s coverage options, limits, and reputation. This will help you choose the policy that best meets your needs.

Working with an Insurance Broker

Benefits of Using a Broker

An insurance broker can provide valuable assistance in finding the right Business Owner Policy Insurance. Brokers have access to multiple insurers and can help you navigate the complexities of insurance policies to find the best coverage for your business.

Finding the Right Broker

When selecting an insurance broker, consider their experience, expertise, and reputation. Look for brokers who specialize in business insurance and understand the specific needs of businesses in your industry.

Finalizing Your Policy

Reviewing the Policy Details

Before finalizing your Business Owner Policy Insurance, carefully review the details to ensure all your needs are covered. Check the coverage limits, deductibles, and any additional riders or endorsements that may be included.

Signing and Managing Your Policy

Once you are satisfied with the policy details, sign the agreement and manage your policy by keeping it updated as your business evolves. Regularly review your coverage to ensure that it continues to meet your needs.

Common Mistakes to Avoid

Underestimating Coverage Needs

Risks of Inadequate Coverage

One of business owners’ most common mistakes is underestimating their coverage needs. Inadequate coverage can leave your business vulnerable to significant financial losses. Ensure you assess your risks thoroughly and choose coverage that provides adequate protection.

How to Avoid Underinsurance

Work with an insurance expert to evaluate your coverage needs to avoid underinsurance. Regularly review and update your policy as your business grows and changes to ensure you are always adequately covered.

Ignoring Policy Updates

Importance of Regular Reviews

Ignoring policy updates can result in gaps in coverage. Regularly review your Business Owner Policy Insurance to ensure it reflects any business operations or risk profile changes. This helps maintain comprehensive protection for your business.

Adjusting Coverage as Your Business Grows

As your business grows, your insurance needs may change. Adjust your coverage for new risks, increased property values, or expanded operations. Keeping your policy up-to-date ensures you continue receiving the protection you need.

Case Studies and Examples

Real-Life Examples of Business Owner Policy Insurance in Action

Small Business Cases

Consider the case of a small retail store that experienced a fire. With Business Owner Policy Insurance, the store could cover the costs of repairs and lost income, allowing the business to reopen and continue serving its customers.

Large Business Cases

In another example, a large manufacturing company faced a major lawsuit due to a product defect. The General Liability Insurance component of their Business Owner Policy Insurance covered legal fees and settlements, protecting the company from substantial financial loss.

Conclusion

Recap of the Importance of Business Owner Policy Insurance

In conclusion, Business Owner Policy Insurance is vital for protecting your business from various risks and liabilities. By providing comprehensive coverage, this insurance helps safeguard your assets, ensure business continuity, and provide peace of mind.

Encouragement to Take Action

If you haven’t already, consider reviewing your insurance coverage and exploring Business Owner Policy Insurance options. Securing the right coverage will help protect your business and support your growth and success.

Additional Resources

Recommended Reading

Explore additional resources and guides on Business Owner Policy Insurance to deepen your understanding and make informed decisions about your coverage needs.

Insurance Calculator Tools

Use online insurance calculators to estimate your coverage needs and understand potential costs. These tools can help you make more informed choices when selecting a policy.

Contact Information for Insurance Experts

For personalized advice and assistance, contact insurance experts who can provide guidance tailored to your business’s specific needs. Their expertise will help you navigate the complexities of Business Owner Policy Insurance and find the best coverage for your business.

Leave a Reply